Let me be very clear:I’ve received $526,591.74 in business funding from Stripe — with no credit check, no interest, and no bank involved.

And I’m going to show you exactly how I did it, with screenshots of my loan agreements, the breakdown of the terms, and how you can use this same strategy — if your business is structured correctly.

Most people think it’s impossible to get that kind of money without using personal credit.But that’s only because they’ve never been taught how this works.

📊 My Stripe Loan Timeline

M.A.C. Enterprise Consulting – May 28, 2024 – $94,600

Magnolia Springs Wedding & Event Center – June 24, 2024 – $10,600

M.A.C. Enterprise Consulting – October 15, 2024 – $87,500

M.A.C. Enterprise Consulting_Heartbeat – November 14, 2024 – $22,500

Magnolia Springs Wedding & Event Center – November 25, 2024 – $22,000

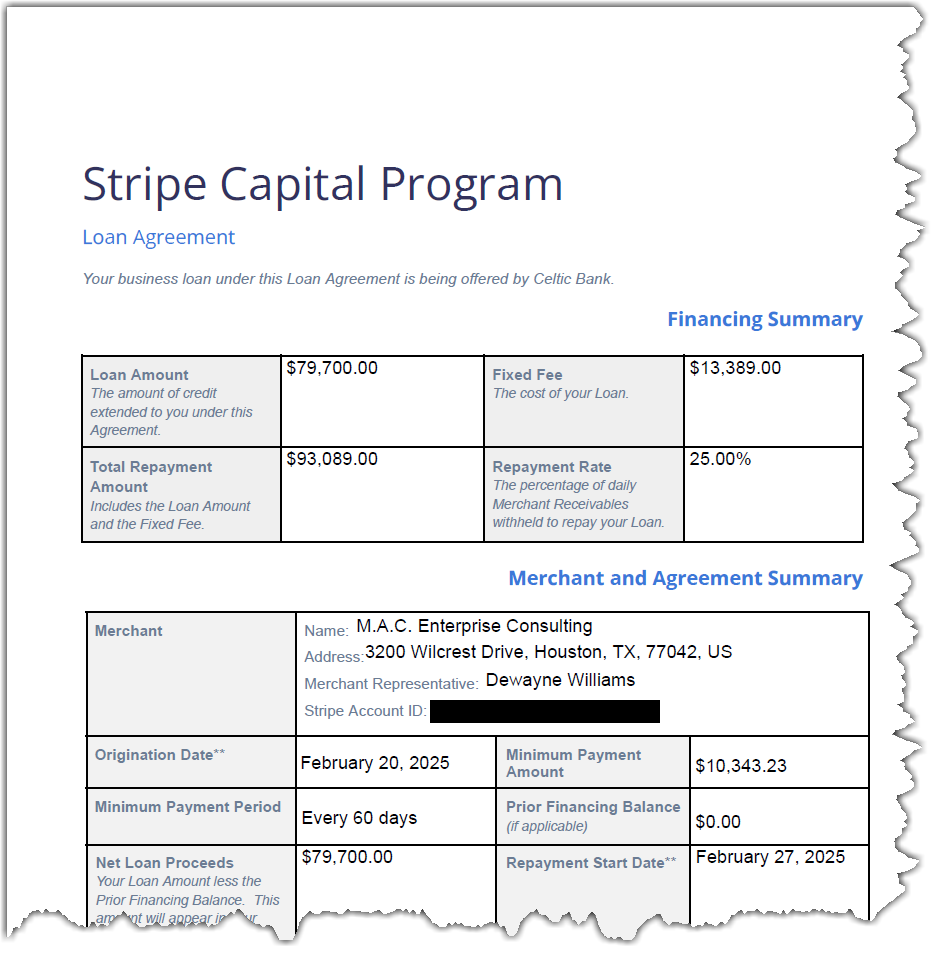

M.A.C. Enterprise Consulting_Heartbeat – February 20, 2025 – $79,700

M.A.C. Enterprise Consulting – March 10, 2025 – $209,691.74

✅ TOTAL: $526,591.74 — all in under 10 months.

💡 Average time between each loan: Every 1–2 months

🧠 Why Stripe Capital Works When Banks Don’t

Let me tell you what no bank will ever do:

✅ Give you over half a million dollars

✅ With no personal credit check

✅ With no interest rate

✅ Let you repay every 60 days

✅ And build your business credit at the same time

But Stripe will — if your business is structured and set up the right way.

Stripe determines funding based on your business revenue, not your personal credit score.And the more you’re doing B2B (business-to-business) transactions, the better your loan offers become over time.

They also report to the Small Business Financial Exchange, which helps you build your business credit profile — completely separate from your personal identity.

🔍 Still Don’t Believe It? Let Me Show You the Actual Stripe Agreement…

I get this question all the time:

“But what’s the interest rate?”

There isn’t one. Stripe charges a flat fixed fee — no APR, no compounding, no surprises. Let me break it down for you using the exact wording Stripe provides in the agreement.

🧾 Loan Amount

The amount of credit extended to you. This is what Stripe deposits into your business account.

💰 Fixed Fee

This is the cost of the loan. There’s no interest — just one flat fee.

Example: If your loan is $100,000 and the fixed fee is $6,000, you repay $106,000. That’s it.

🔁 Total Repayment Amount

Your Loan Amount + Fixed Fee. The total amount due. No surprises.

📉 Repayment Rate

The percentage Stripe withholds from each transaction to pay down the loan.

Example: If your repayment rate is 15% and someone pays you $1,000, Stripe takes $150 and applies it to your loan.

⏱️ Minimum Payment Amount (Every 60 Days)

You only have to meet a minimum repayment amount every 60 days.

If your normal transactions haven’t paid enough toward the loan during that time, Stripe will deduct the difference at the end of the 60-day period. But if you hit the minimum early, you just keep paying through sales — no penalties.

No bank is letting you make a payment every two months.Stripe is.

⚠️ Wait — This Won’t Work If You Have an LLC

Now here’s the part nobody tells you…

If you want business funding WITHOUT using your personal credit history, you CANNOT do this with an LLC.

LLCs are considered disregarded entities by the IRS — meaning your business is not legally separate from you. Stripe and similar lenders know this, which is why using a single-member LLC often triggers a personal credit check.

This screenshot is directly from Stripe’s website — confirming that under certain circumstances, applying can involve your personal credit.

And here’s the key:

✅ The ONLY way to get business funding without them using your personal credit is to have your Stripe account opened under a C-Corporation.

That’s why I structured my companies using C-Corporations, with a parent company, holding company, and REIT — and that’s exactly what I do for my clients through the Legacy Builder.

💼 This Is Why I Created the Legacy Builder

None of this would’ve been possible without the right foundation.

If your business isn’t structured right, you’re not even in the game. That’s why I built the Legacy Builder — a complete setup to give you everything you need to access funding like this.

When you invest in the Legacy Builder, you’ll get:

✅ Operating Company

✅ Parent Company

✅ REIT (Real Estate Investment Trust)

✅ Holding Company

✅ Non-Profit + 501(c)(3) Application

✅ Commercial Lease in Wyoming

✅ My Masterclass — FREE

✅ Business Plan — FREE

✅ Membership Access — FREE

💥 Over $18,000 in value — for just $5,999 or $6,499 (with Non-Profit option)

And you get your money back in less than 6 months???

🚀 Your Return on Investment? Faster Than You Think

I received my very first payment on Stripe on July 4, 2023 — and by May 28, 2024, I was approved for my first $94,600 loan.

At the time, Stripe’s policy required businesses to process payments for at least 6 months before being eligible for funding. It wasn’t until late 2024 that Stripe updated their requirements, allowing some accounts to become eligible after just 3 months of processing.

So I did it the long way — and still secured nearly $100K in under 11 months without ever using my personal credit.

Today, most of my clients are seeing loan offers within 3 to 6 months, depending on how active their Stripe account is and how their business is structured.

And the best part? With Stripe’s system, you can keep getting repeat funding every few months as your business continues to grow.

✅ Final Thoughts

This isn’t a gimmick.

It'snot a grant.

It's not a personal loan that hits your credit.

This is real business funding based on real structure and strategy.If you're still using an LLC and hoping for bank approval — it’s time to evolve.

🔗 Ready to Build It the Right Way and Get Funded Like I Did?

👇 Click below to get started with the Legacy Builder.Let’s set up your business properly and get you on track for real money — the smart way.

Comments